What kind of economic recovery from the Covid-19 crisis should we expect? Attempts to answer this question must start by acknowledging an unusually high degree of uncertainty about the immediate future. There is uncertainty about the recurrence of the virus, about how policy makers will balance public health and economic goals, and about the ability of governments to ramp up their capacity to test, trace and isolate the infected, thereby making it safe for others to return to work. Further sources of uncertainty include the behavioral responses of households and investors, the sustainability of the extraordinary monetary and fiscal policies adopted in response to the crisis, and the extent to which economic organization will change in the new public-health environment. These aspects of the current crisis and their contrasts with crises past suggest that recovery from the Covid-19 crisis will be bumpy, subdued and above all uncertain, and that it will differ in Europe and the United States.

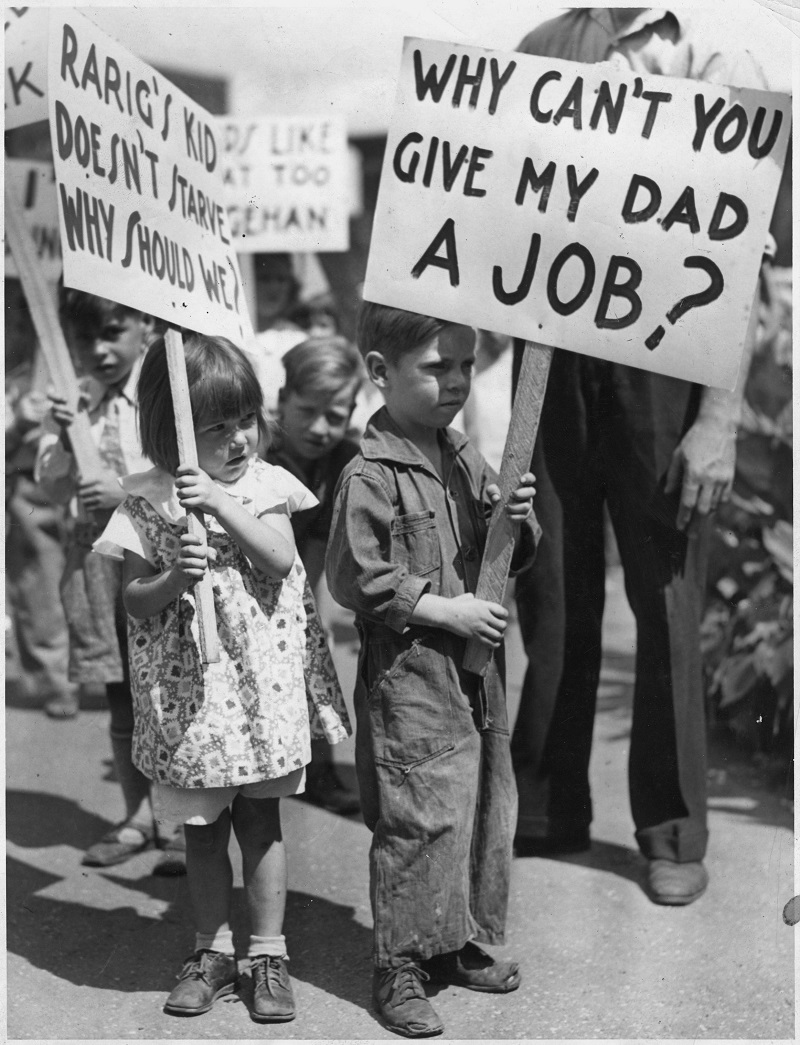

What would be an economic survival like in a post-Coronavirus era? This is a question that historians, particularly economic historians who study the Great Depression, are asked with regularity. The question is pressing, and to whom it is directly is not entirely surprising. Human beings, cognitive scientists tell us, have an instinctual tendency to reason by analogy, and history is a rich source of analogies.(1) It follows that as unemployment rises to Great Depression levels we are asked “Could this downturn be as deep and protracted as the Great Depression of the 1930s?” As observers look forward, they similarly ask “Will recovery from this crisis resemble recovery from the Great Depression?”

In practice, history is an imperfect guide to the future, however much we would like it to be otherwise. Each new crisis differs from its predecessors in important respects. Historical analogies are useful therefore mainly for helping to identify what is distinctive about current circumstances. While history provides a perspective for thinking about current events, it is not a crystal ball. It doesn’t tell us what to expect.(2)

Elevated Uncertainty

To start, it is crucial to acknowledge the existence of an unusually high level of uncertainty around the current crisis and how it might end. Above all, there is uncertainty about the course of the virus. How will it respond to warmer weather? If it dies down in the summer, will it return in the fall? Will it return multiple times? Will it mutate? What share of individuals contracting the virus will develop immunity? These questions illustrate the limitations of historical evidence. There is the 1918 Spanish Flu pandemic with which to compare, but every coronavirus is different.(3) In any case, these are questions that epidemiologists and not economists are best placed to answer.

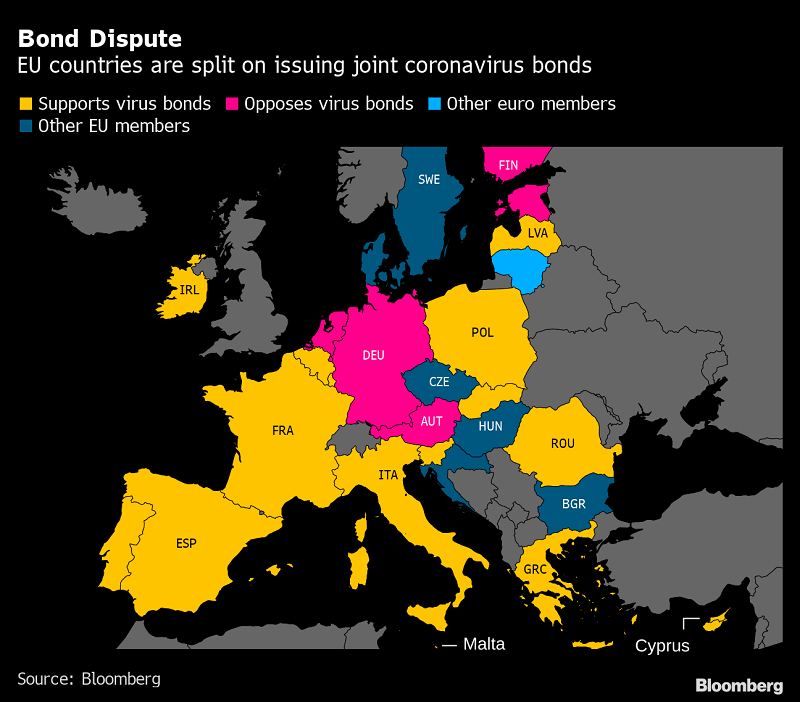

There is also an unusually high degree of uncertainty surrounding the policy response. This is true because U.S. policy is, to a large extent, in the hands of Donald Trump, who is himself unusually unpredictable. Will Trump listen to his economic advisors or to his medical advisors when deciding when it is safe to reopen the economy? If he reopens it too soon, will he then be forced to shut it back down? There is a high degree of uncertainty about Europe’s policy response as well, given increasingly strident disagreements between Northern and Southern European governments over Coronabonds and related proposals for debt mutualization.(4)

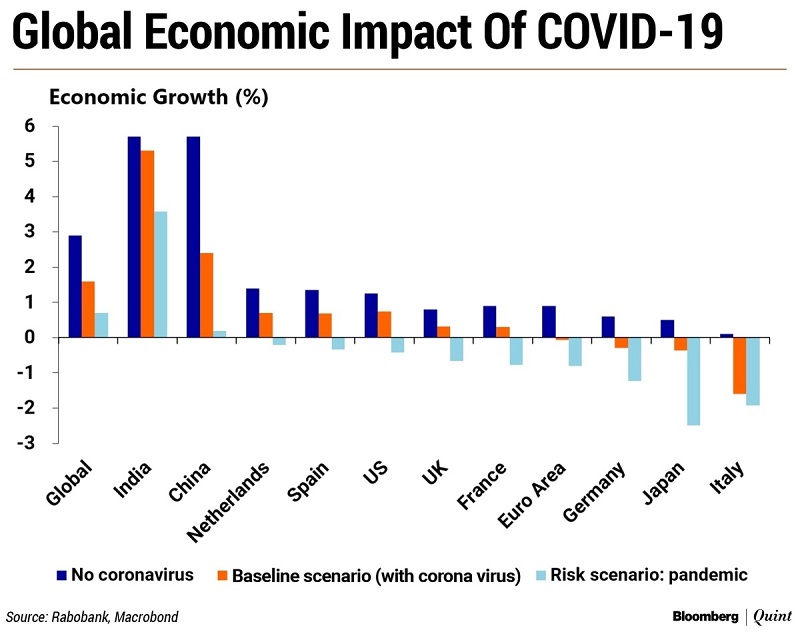

A further source of uncertainty stems from the global nature of the crisis. Even the financial crisis of 2008-9 was not truly global in scope; many emerging markets and developing countries skated through largely unscathed.(5) But the global scope of the pandemic and the widespread economic shutdowns imposed in response create the possibility that the U.S. and Europe could begin to recover but that their recoveries might then be blown off course as emerging markets and developing countries succumb and we in the West reimport economic weakness and, even worse, reimport the virus itself.

Most fundamentally, the contours of any recovery will be determined by how quickly and efficiently we ramp up the capacity to test, trace and isolate the infected, since the ability to determine who is infected and who is immune will dictate when it is safe to return to work. Except in a handful of Asian countries, governments have only begun to scale up testing to the necessary extent. Western societies are more reluctant to track and trace owing to confidentiality concerns and, in the U.S. citizens’ deep and abiding suspicion of government.(6) Much will depend, therefore, on private sector initiatives. One hears of promising reports such as the joint Google-Apple initiative to develop a smartphone app for use in identifying the locational histories of infected persons and then broadcasting alerts to bystanders. Similarly, if testing by government remains inadequate, perhaps companies will step up. Already there are reports that Amazon is developing plans to test its employees daily when they arrive at its fulfillment centers.(7)

Behavior and Policy

Then there is uncertainty about the behavioral response. Households will almost certainly engage in more precautionary saving, as people realize that they lack adequate financial reserves to deal with unexpected shocks. This was similarly the effect of the Great Depression: personal savings rates in the United States rose by half between 1929, the previous business cycle peak, and 1935-40, the subsequent recovery period. Firms for their part will hesitate to invest, preferring first to see whether the virus returns. More generally, there will be a shift in investment in more conservative, risk-averse directions, just as there was following the Great Depression.(8) These observations suggest that private spending will remain subdued and that the demand for risk assets will be limited, behavioral responses that will slow the recovery, other things equal.

Governments can ramp up public spending to replace the private spending that is lost, but in doing so they will confront a further source of uncertainty, namely the financial market response. The historical regularity is that interest rates on advanced-country government bonds rise by 4 basis points (4/100 of a percentage point) in response to every 1 percentage point rise in the ratio of debt to GDP.(9) This suggests that if debt-to-GDP ratios rise by 25 percentage points in response to the crisis, as seems likely, interest rates will still rise by only a relatively modest 1 percentage point. In the U.S. case, this means that they will rise from 0.75 per cent, the level around which they currently fluctuate currently, to 1.75 per cent, still very low levels by historical standards. But this assumes that financial markets respond in the future as they did in the past. It assumes that central banks will continue to do their part to cap rates. About this, unfortunately, no is no guarantee.

More generally, there is uncertainty about the economic policy response. Will politicians and officials start worrying prematurely about higher levels of public debt and turn to austerity too early, as U.S. and European policy makers did in 2010, thereby precipitating a double-dip recession?(10) Will there be complaints that central banks, in undertaking unprecedented interventions, are bailing out big investors and enriching institutions like PIMCO and State Street, fomenting a reaction against central bankers and their policies similar to that which animated the Occupy Movement?(11) Will the U.S. and Europe continue to follow very different approaches to protecting labor, where European governments are pursuing ambitious policies to encourage firms to retain workers on payroll, whereas the U.S. government is allowing firms to lay off workers big time? If so, what will the longer-term consequences be for the pace and shape of America and Europe’s respective recoveries?

Finally, how will the structure of the economy change, and what will such changes imply for the recovery? The risks of asking people work in close proximity to one another are already accelerating the process of automation.(12) Moving to shorter supply chains, as firms de-risk by producing closer to home, will raise costs, other things equal.(13) Some sectors, such as health care and on-line shopping, will expand, while others, most obviously restaurants, hospitality and travel, will contract. How extensive will these structural shifts ultimately be, and how will they condition the recovery?

History Lessons

Although history doesn’t repeat, it often rhymes, as Mark Twain purportedly said. Thus, the crisis can shed at least limited light on these questions. History suggests that it is conceivable – but unlikely – that we will see a V-shaped recovery. Suggestively, the U.S. economy’s recovery from the Great Depression was decidedly V-shaped. The U.S. economy grew at an average annual rate of 8 per cent between 1933 and 1937 and then at an annual rate of 10 per cent between 1938 and 1941, much faster than before.(14) In part, this rapid growth resulted from putting idle resources back to work. And there were idle resources aplenty, given that industrial production had fallen by 50 per cent and that a quarter of the labor force was unemployed, similar to the situation we look to be facing now. That said, even if growth starting in 1933 was impressively fast, putting those idle resources back to work involved more than simply flipping a switch. It took fully four years – almost exactly 48 calendar months – to get back to the level of industrial production reached at the business cycle peak in 1929. This suggests that even in the best-case scenario, we have a long road ahead.

These calculations purposely leave out an important data point: 1937-38, when the U.S. suffered a double-dip recession. The economy lapsed back into recession because of the premature withdrawal of policy support – because the Federal Reserve tightened in response to fears of inflation and President Franklin Delano Roosevelt moved to balance the budget before private spending had recovered fully.(15) We similarly saw the premature withdrawal of policy support following the 2008-9 financial crisis, when both the U.S. and Europe shifted to austerity already in 2010. The IMF’s former chief economist Olivier Blanchard has warned of the danger of another “Oh my god what have we done?” moment this time – that there will be an instinctual tendency to retrench in a year or two. Before succumbing to that temptation, it will be important to examine the state of the economy and to determine whether there in fact is a need for continued policy support.

Relatedly, the productivity of the U.S. economy (what economists call total factor productivity) rose more rapidly in the 1930s than in any other 20th century decade.(16) This fact is consistent with the idea that crises create opportunities to re-think how we go about our business and increase efficiency; this idea is sometimes referred to as the “recessions as reorganizations” hypothesis.(17) It is at least conceivable that firms will similarly take advantage of downtime now to reorganize along more efficient lines. Again, the impetus the crisis is giving to automation is at least superficially consistent with this hypothesis.

But this possibility hinges on the assumption that firms are prepared to undertake major investments in new technologies and new ways of doing business, which, as argued before, is implausible so long as the virus remains around. Moreover, it ignores the fact that reorganization, while it is underway, is disruptive. General Motors currently may be shifting from making motor vehicles to making ventilators because that’s where the demand will be for the foreseeable future. But its output will go down before it goes up, since it will have to first re-train its workers and re-tool its assembly lines.

Careful analyses of U.S. experience in the 1930s suggest that the rapid productivity growth of that decade reflected not reorganization during downtime but rather the maturation of earlier developments – that is, it reflected the payoff from earlier disruptions. There was the reorganization of the factory floor to take advantage of the availability of self-standing electric motors, a process that had been ongoing since the 1890s. There was the completion of a national network of tarmacked roads and highways, similarly a process that had been underway for decades, which facilitated the shift from railways to more flexible trucking and significantly enhanced the efficiency of transportation and distribution.(18)

What Kind of Recovery?

First, the recovery will be bumpy, since there may be the need to close back down parts of the economy if and when the virus returns. It will be bumpiest in countries with the least trust in government and least capacity to test, trace and isolate the infected.

Second, recovery will be slowed by higher rates of precautionary saving and lower levels of fixed investment compared to the pre-crisis period, as households and firms absorb the lessons of the crisis. As a result of these behavioral changes, private spending and hence aggregate demand are likely to remain subdued for some time. The drag from weak private spending can be offset by strong public spending so long as interest rates remain at their current low levels. This last observation suggests that recovery will be faster in countries with fiscal space (where debts and deficits were relatively low prior to the crisis). It will be faster where governments have their own central banks and can borrow from residents in their own currencies. By implication, there is more reason for optimism about recovery prospects in the U.S. and UK than in the Euro Area and emerging markets.(19)

Third, recovery will be helped along by the preservation of financial stability, assuming that we continue to preserve it. In the 1930s, the collapse of banking and financial systems was the single most serious obstacle to renewed growth. In contrast, banks in most countries entered the Covid-19 crisis in a stronger position than in 1929, and for that matter than in 2008. Central banks are on the case; they are responding more competently than in 1929 (which, admittedly, is not saying much) and more rapidly and powerfully even than in 2008.

Here is an instance where resort to historical analogy has informed policy in positive ways. Central banks learned in 2008 that what matters in the 21st century is not just the stability of the banking system, which was at the center of the 1930s crisis, but also the stability of other financial institutions and markets (known colloquially as the “shadow banking system”). Central bankers have now dusted off the playbook assembled in 2008 and are expanding it even further. As renters continue to miss payments and homeowners miss mortgage installments, there will be failures of banks and mortgage servicers, no doubt, forcing central banks and governments to step in. But there is reason to hope that they have learned how to step in so as to avoid wholesale destabilization of the financial system.

Fourth, recovery will face headwinds insofar as resources will have to be shifted from contracting sectors such as tourism, restaurants and hotels and toward expanding sectors such as health care and distance learning. Retraining hotel employees as nurses will take time, and these workers will not be as productive in the interim.

This last point brings us back to the contrasting labor market strategies of the U.S. and Europe, where European governments are subsidizing and otherwise encouraging firms to keep their workers on payroll, something that the U.S. is doing to a much lesser extent. The U.S. approach will cause more damage to human capital, as American workers experience more hardship, see their healthcare expire, and lose connections with their employers. Some of these workers will be scarred psychologically, as unemployed workers often are, rendering them less productive when they return to work.(20) But because unemployed Americans will have lost their connection to their previous employer, they will be faster to redeploy to other sectors and activities. In Europe, by comparison, the damage to human capital will be less, but the reallocation of resources, including workers, to new sectors and activities will be slower. Which approach is more favorable from the perspective of economy-wide productivity and growth? Only time will tell.

(1) An introduction to the literature in cognitive see is Usha Goswami, “Analogical Reasoning in Children,” in Dedre Gentner, Keith Holyoak and Boicho Kikniov (eds), The Analogical Mind: Perspectives from Cognitive Science, Cambridge, Mass.: MIT Press (2001), pp.437-470. On historical analogy specifically, see Barry Eichengreen, “Economic History and Economic Policy,” Journal of Economic History 72 (2012), pp.289-307.

(2) A thoughtful treatment that runs in parallel with this discussion is Hal Brands and Jeremi Suri eds, The Power of the Past: History and Statecraft, Washington, D.C.: Brookings Institution Press (2015).

(3) Mark Terry, “Compare: 1981 Spanish Influenza Pandemic versus Covid-19,” BioSpace (April 2, 2020), https://www.biospace.com/article/compare-1918-spanish-influenza-pandemi….

(4) A short introduction to the Coronabond debate is David Dawkins, “Coronabonds and the Eurozone – The Crisis at the Heart of Europe’s Pandemic Recovery,” Forbes (April 7, 2020), https://www.forbes.com/sites/daviddawkins/2020/04/07/what-are-coronabon….

(5) See the discussion in Donghyun Park, Arief Ramayandi and Kwanho Shin, “Why Did Asian Countries Fare Better during the Global Financial Crisis than during the Asian Financial Crisis?” in Changyong Rhee and Adam Posen (eds), Responding to Financial Crisis: Lessons from Asia Then, the United States and Europe Now, Washington, D.C.: Peterson Institute of International Economics (2013), pp.103-139.

(6) On Western perspectives, see Chris Clark and Janice McGhee eds, Private and Confidential? Handling Personal Information in Social and Health Services, Bristol: Polity Press (2008).

(7) See Andy Greenberg, “How Apple and Google are Enabling Covid-19 Contact Tracing,” Wired (April 18, 2020), https://www.wired.com/story/apple-google-bluetooth-contact-tracing-covi…; J. Edward Moreno, “Amazon Developing Lab to Test Workers for COVID-19,” The Hill (April 9, 2020), https://thehill.com/policy/technology/492146-amazon-developing-lab-to-t….

(8) Thus, Ulrike Malendier and Stefan Nagel have shown that “Depression babies” whose formative years coincided with the difficult economic and financial environment of the 1930s were less willing to take financial risks subsequently. See Ulrike Malmendier and Stefan Nagel, “Depression Babies: Do Macroeconomic Experiences Affect Risk Taking?” Quarterly Journal of Economics vol. 126 (2011), pp.373-416.

(9) This estimate follows Cinzia Alcidi and Daniel Gros, “Public Debt and the Risk Premium: A Dangerous Doom Loop,” EconPol Opinion 21 (June 2019).

(10) See Barry Eichengreen, Hall of Mirrors: The Great Depression, the Great Recession – and the Uses and Misuses of History, New York: Oxford University Press (2015).

(11) On April 6th, the Federal Reserve announced that it had selected PIMCO as asset manager for its Commercial Paper Funding Facility and State Street as administrator for the program. James Comtios, “Fed Picks PIMCO, State Street for Commercial Paper Funding Facility,” Pensions and Investments (April 6, 2020), https://www.pionline.com/money-management/fed-picks-pimco-state-street-….

(12) See Michael Corkery and David Gelles, “Robots Welcome to Take Over, as pandemic Accelerates Automation,” New York Times (April 10, 2020), https://www.nytimes.com/2020/04/10/business/coronavirus-workplace-autom….

(13) There existed a nascent literature on this issue even before the emergence of the Coronavirus: see for example George Zsidsin and Michael Henke eds, Revisiting Supply Chain Risk, Berlin: Springer (2019).

(14) Christina Romer, “What Ended the Great Depression?” Journal of Economic History 52 (1992), pp.757-784.

(15) On monetary and fiscal policies respectively, see Milton Friedman and Anna Schwartz, A Monetary History of the United States, 1867-1960, Princeton: Princeton University Press (19630; E. Cary Brown, “Fiscal Policy in the ‘Thirties: A Reappraisal, American Economic Review 46 (1956), pp.857-879.

(16) The point is most forcefully made by Alexander Field, A Great Leap Forward: 1930s Depression and U.S. Economic Growth, New Haven: Yale University Press (2012). On the meaning of total factor productivity, see Robert Shackleton, “Total Factor Productivity Growth in Historical Perspective,” Working Paper 2013-01, Washington, D.C.: Congressional Budget Office.

(17) Robert Hall, “Recessions as Reorganizations,” Paper presented to the NBER Macroeconomics Annual Conference, https://web.stanford.edu/~rehall/All_publications.htm.

(18) On these points see Field, Great Leap.

(19) The limits and risks of foreign-currency-denominated debt, sometimes known as “original sin,” are discussed in Barry Eichengreen and Ricardo Hausmann, “Exchange Rates and Financial Fragility,” in Federal Reserve Bank of Kansas City ed., Proceedings of the Jackson Hole Economic Policy Symposium, Kansas City, MO.: Federal Reserve Bank of Kansas City (2000), pp.329-368.

(20) See Nicholas Crafts, “Long-Term Unemployment in Britain in the 1930s,” Economic History Review XL (1987), pp.418-432; Jesse Rothstein, “The Lost Generation? Scarring after the Great Recession,” unpublished manuscript, University of California, Berkeley, https://eml.berkeley.edu/~jrothst/.