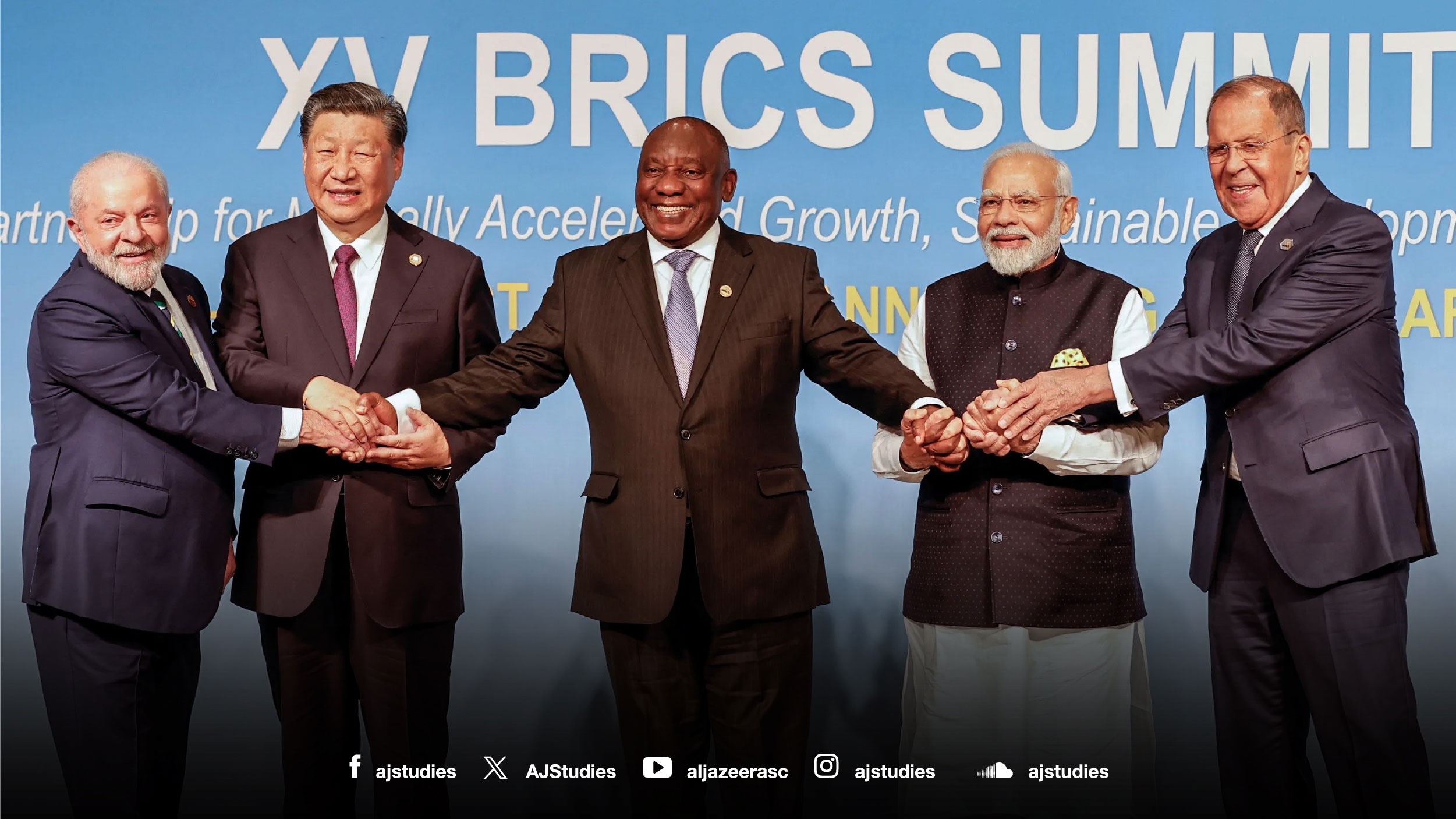

The 15th meeting of the leaders of the BRICS countries, which opened in Johannesburg on 22 August 2023, received outsized media attention, coming as it did amid the intensification of the war in Ukraine and the escalation of the political-economic rivalry between the United States and China. Global news coverage was largely focused on the admission of new members and what this would mean for the future of the BRICS group and its economic and geopolitical ambitions.

BRICS came together as a trade bloc of the major emerging economies in 2009 following the global financial crisis. Although each of its original members—Russia, China, India and Brazil—had its own particular motives for joining, they all sought to strengthen their global economic position independent of the Western-dominated financial and economic order. In 2015, the group created an emergency monetary system and the New Development Bank, conceived as alternatives to the International Monetary Fund and the World Bank. The same year China established its own interbank payment system, seeking to make the yuan an international currency of exchange and payment that could compete with the US dollar. It was not until 2022, however, after the war in Ukraine erupted, that BRICS began to be seen as a potential geopolitical counterweight to the Euro-Atlantic bloc.

Achieving these ambitions requires greater coordination and integration than was on display at the summit. The BRICS cannot be an effective counter to the dollar-dominated global economy without a single competing currency, whether a new currency or the Chinese yuan, and thus far, China’s yuan-based payment system has not strengthened the currency’s international position. In July, it was estimated that the dollar accounted for 46 percent of all payments across the world, followed by the euro, the Japanese yen, and finally the yuan. Moreover, China’s opaque monetary policies are an obstacle to making the yuan a medium of global exchange. Agreement on a single currency similar to the euro requires consensus around member states’ general monetary and fiscal policies. This is a daunting prospect considering the very different political systems of BRICS countries; and unlike the EU, they are not neighbours and do not share a common cultural heritage.

Geopolitics also make consensus more difficult. India is a member of the Quadrilateral Security Dialogue, a Western-led alliance designed to counter China in the Indo-Pacific region. South Africa and Brazil also have strong economic ties to the Euro-US bloc and show no desire to antagonise the West. Meanwhile, Russia fears growing Chinese influence in Central Asia.

The expansion of BRICS, announced soon after the summit, complicates matters further. While the six new members—Egypt, Argentina, Saudi Arabia, the United Arab Emirates, Iran and Ethiopia—will diversify the economic base of the bloc, each has divergent reasons for joining. Egypt, for example, is on the verge of bankruptcy and is looking for support for its crumbling economy, while Saudi Arabia and the UAE are seeking to bolster their ties with emerging industrial markets.

Freedom from Western economic and political hegemony requires the development of a broad economic and monetary consensus that embraces numerous countries around the world; and it must be backed by a solid political will. The BRICS bloc faces problems with both sides of this equation: it has been slow to come to a workable economic-monetary consensus and its members do not share the political will to make that consensus a reality. The expansion of the bloc is likely to further hinder this process, introducing additional competing agendas and conflicts to the group. The final statement issued by the summit underlined this dilemma. Even as it asserted the need for a more pluralistic world and a fairer distribution of resources and wealth, it affirmed support for democratic values, state sovereignty and non-aggression, seeming to offer a critique not only of the Western-led order, but also of the Chinese political system and Russian bellicosity.

Despite the complexities and difficulty of the single currency project, the BRICS group can become a space for closer bilateral relations between members. Local currencies or the yuan are already being used to settle payments in inter-BRICS bilateral trade, and this practice will undoubtedly become more common. Even if it does not amount to a single-currency regime on par with the dollar or the euro, it is nevertheless a concrete step on the road of liberation from Western monetary-economic domination. Similarly, as the New Development Bank grows stronger thanks to the inclusion of new BRICS members, it can also offer assistance to troubled BRICS economies without the prejudicial conditions typically imposed by Western-led international financial institutions.

There is still a long way to go, however, before BRICS becomes a significant economic-political force in the global arena.

*This is a summary of a policy brief originally written in Arabic available here.