When asked about the future of oil, Sheikh Ahmed Zaki Yamani, the former Saudi Arabian Minister of Oil, said, “the Stone Age did not end for lack of stone, and the Oil Age will end long before the world runs out of oil.” (1) Whilst the world still has a dependency on oil, the moral behind Yamani’s decades-old remark reminds us that change has an inevitability in the energy sector. Back in 2011, the International Energy Agency (IEA) predicted the ‘Golden Age of Gas’ was before us. (2) The assertion was that natural gas was poised to be an irresistible fuel source, which came with fewer environmental pains than using oil. Adding to this, given the post-Fukushima concerns over nuclear energy, gas-fired power stations were destined to be more attractive as they could be fueled by liquid natural gas (LNG) as a globally traded commodity.

With the right investment in unconventional gas resources, coupled with greater deregulation, the Gas Golden era could be nurtured. Whilst the IEA’s prediction had a degree of hubris in predicting demand, the changing landscape with regard to supply can only be categorized as ‘revolutionary’. The IEA estimated that from 2015 to 2021, the total global export capacity of LNG is projected to rise by 45%, and the market fundamentals to be one of an oversupplied market, leading to depressed prices. (3) Now new producers in the LNG sector are emerging and the rise of these countries signals rapid changes, which will have a broader impact on international relations. Yet also, the main buyers of LNG are now cooperating which poses a challenge for producing countries. These changes come with clear geopolitical implications and therefore justifies a discussion that will be the purpose of this paper.

The Rise of New LNG Giants

The global LNG market is in the midst of a significant shift, driven by the emergence of advances in technology, discoveries and also regarding how LNG is both traded and priced. For dominant LNG exporters such as Qatar, this translates to a new chessboard on which its energy policy will be played out. Three countries stand out as emerging significant players, who will join Qatar, in terms of being giants of global LNG exports: Australia, United States of America, and Russia. (4) They are set to reshape the global natural gas sector in the coming years. Regarding exporting gas as LNG, the sector has, thus far, been dominated by Qatar, and its closest rivals of Malaysia, Nigeria, and Indonesia remain far behind Qatar’s dominant export capacity. Nevertheless, two trends have come to redefine the industry and the emergence of these new centers of significant export capacity. The first was the investment that has gone into developing natural gas production and LNG export capacity.

As LNG is typically priced on an index linked to the price of crude oil, a natural consequence of the average price of crude oil since 2003 having undergone progressive increases, which lasted until 2014, translated to investment. This investment has begun yielding an increase in production of natural gas. A second main reason relates to the exploitation of unconventional resources such as shale and coalbed methane. Both have proved instrumental in enabling export capacity to grow exponentially, which is forcing a recalibration in the global LNG sector.

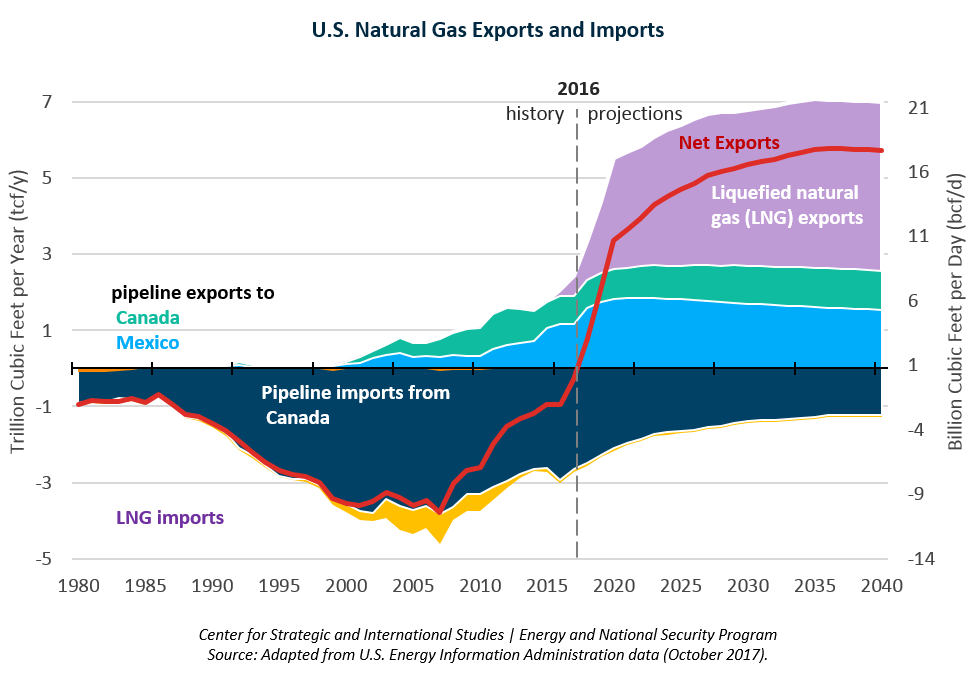

Such trends have proved a blessing for these producing countries, and they are reshaping the global landscape with regard to LNG supply. With regard to the United States, it is worth recognizing that over the last 10-15 years, the United States has swung from being projected as the world’s largest importer of LNG, ahead of Japan and South Korea, to become the world largest producer of natural gas. It has also become a significant exporter of LNG that is poised to compete against traditional suppliers of LNG.

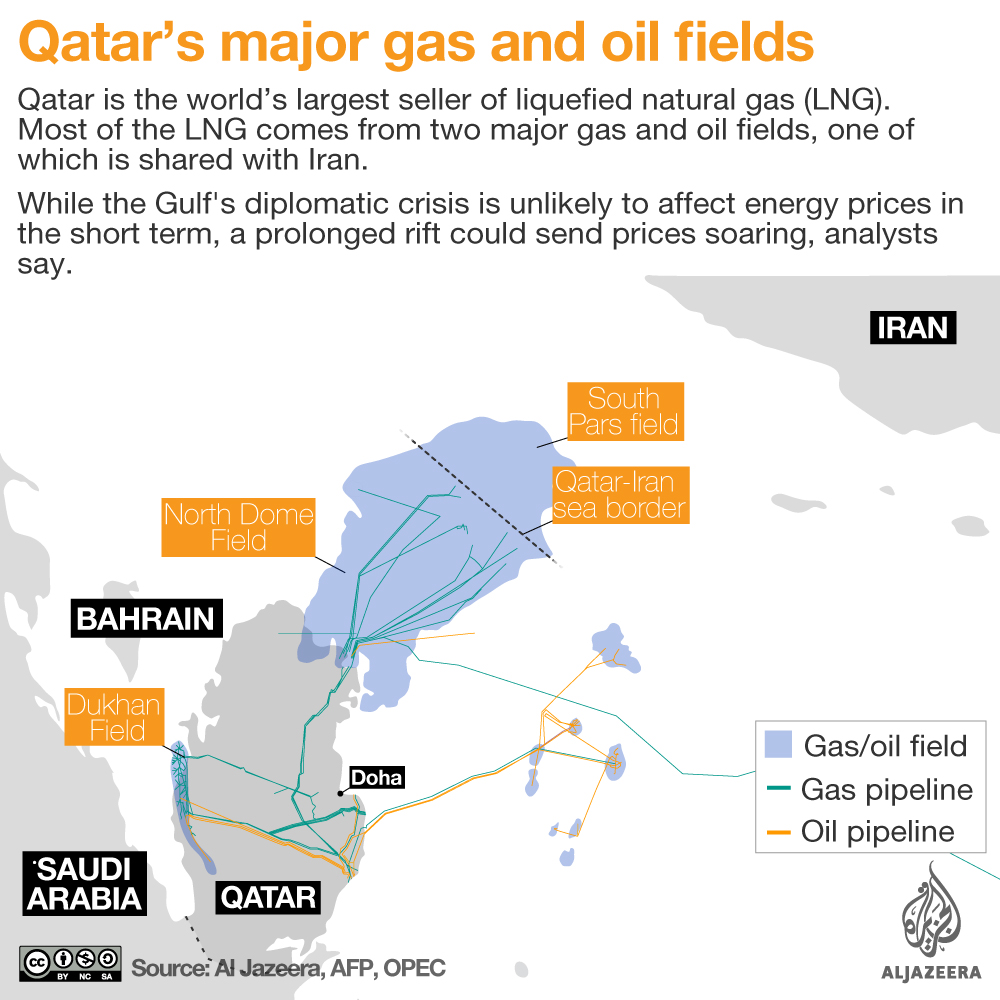

|

| Qatar's major gas and oil fields [Aljazeera] |

This change has been enabled through the exploitation of shale rock for both oil and gas: to put this into perspective; the IEA has estimated that the United States may even exceed Russia and Saudi Arabia as the leading producer of oil in 2018. Such a transformational change in the United States' energy security has implications for traditional suppliers of LNG such as Qatar, but also more broadly in terms of how energy security calculations infuse with US foreign policy calculations. This is especially with regard to the way in which the United States engages at a strategic level with the Arab Gulf region.

The United States has benefited from the now completed $5.3 billion expansion of the Panama Canal. This transit route has reduced the cost of shipping from the US Gulf Coast to Asia by 11 days, which means US LNG can reach the markets in East Asia in around 20 days.(5) In several respects, the widening of the Panama Canal is a game-changer for the LNG industry. It is pertinent to refer to the East Asian market here, as it constitutes the most significant consumer market for LNG as a commodity. Japan remains the leading consuming nation, followed by China and South Korea. Collectively, this tripartite of accounts for 60% of global consumption of LNG. (6)

For LNG supplying nations, the challenge is one of gaining and maintaining market share in this critical region. It is worth noting that the first shipments of US LNG traveled to Hong Kong and Taiwanese markets. More ironically, the United States has already started supplying LNG to both Kuwait and the United Arab Emirates, and it is also favorably positioned to supply LNG to the European market despite its stagnant demand.

One foreseeable occurrence is that the United States may become a swing supplier of LNG. The reason for this is that its sellers typically use what is called a ‘tolling agreement’ system for the sale of LNG, rather than a ‘combined purchase and sale agreement’. In practical terms, this translates to flexibility. A ‘tolling agreement’ sees the customer purchase the gas for delivery to a liquefaction plant, and then pays the operator for having it liquefied. The actual delivery of the LNG by tanker is purely on a contract basis.

The significance of this is that it gives considerable flexibility to the time of sale, supply manner, and volumes in which LNG is sold and procured. A more traditional approach is the ‘combined purchase and sale agreement’ as in this scenario, the seller oversees and controls all three aspects of the sale. Such contracts would come with a 'take-or-pay' clause basis, which restricts the buyer to a set price and volume.

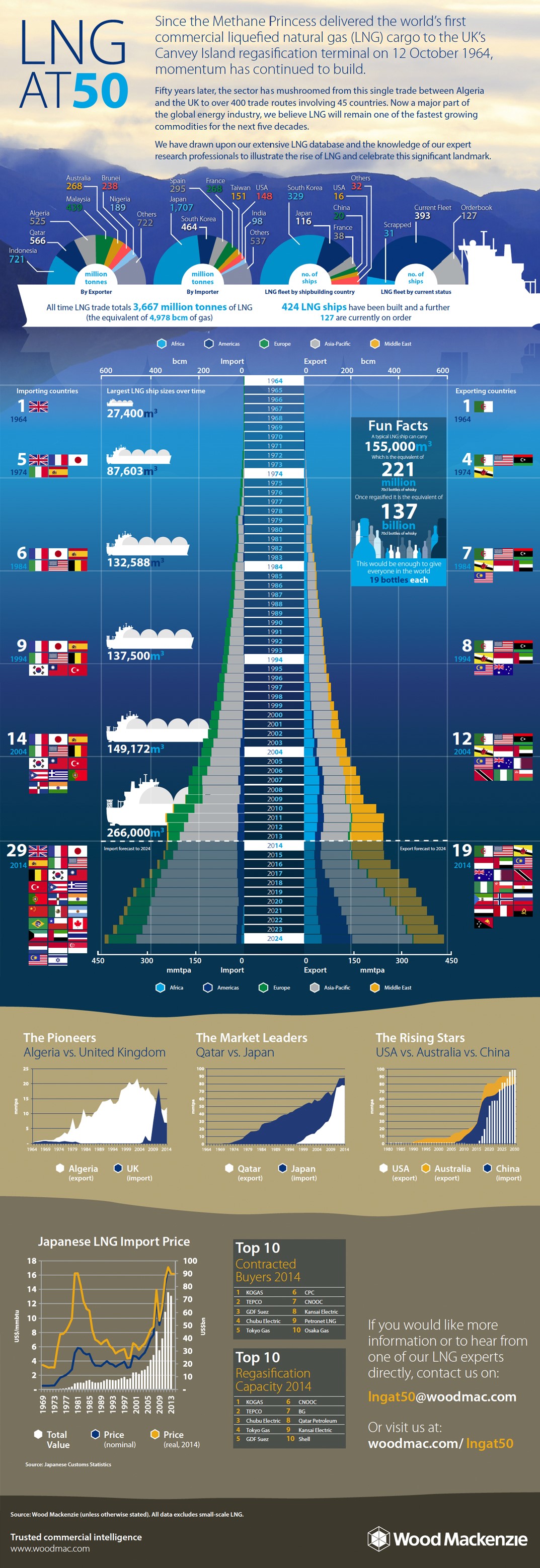

|

| LNG -50-years [Wood Mackenzie] |

Yet, more importantly, is that it is often the case for countries such as Qatar who provide the value of ‘combined purchase and sale agreement’ to set a destination clause for the LNG, meaning that the purchaser cannot resell it to another country. Such destination clause restrictions are generally not practiced by suppliers using a ‘tolling agreement’ sale, as it is inherently a liberalized form of trade. The challenge that US operators pose to the industry and transitional suppliers such as Qatar, is one of flexibility in the sale of LNG. Increasing volumes of LNG can be expected to be sold on a more flexible basis by US-based operators. Whilst Qatar will be able to undercut US cargos in terms of price, the flexibility offered by US-based sellers is also an attractive selling point.

A further rising geopolitical power in terms of LNG exports is Australia. Unlike the United States, this is being driven by its extensive deposits of coal-seam gas. Given its strategic decision to use this natural resource for export purposes, its export capacity has developed rapidly. In 2018, Australia’s exports are expected to peak near Qatar’s own export capacity which it held whilst having a moratorium on further development of its North Field.

It is only through Qatar’s 2017 decision to lift its moratorium to expand its capacity, that it will be in a position to maintain its place as the leading supplier globally. Yet the significance of Australia’s rapid growth in its export capacity, coupled with its geopolitical position near the strategically important East Asian market, that heightened competition for market share has a certain inevitability about it, which is sure to prove a boon for what is becoming a ‘buyers’ market’.

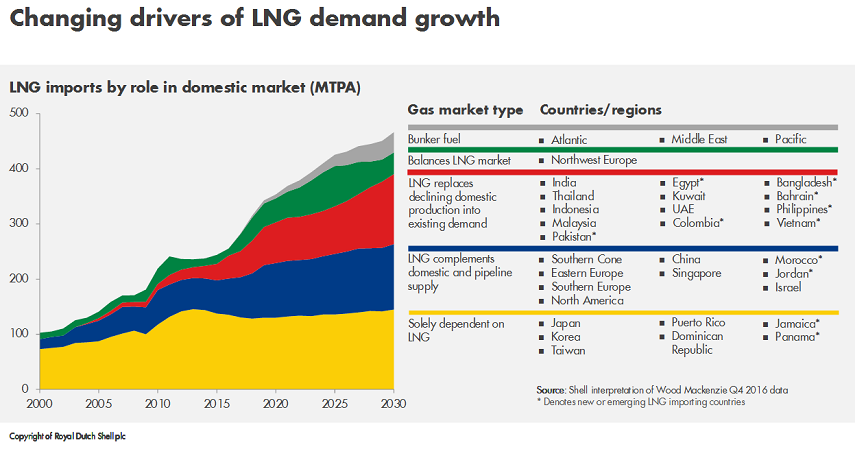

|

| Changing Drivers of LNG demands [Shell] |

A further major player over the coming years will be Russia when it expands its LNG export capacity. Russia is already a leading producer of natural gas, but thus far it has been characterized by the unrealized potential in terms of LNG as the focus has been on natural gas. The genesis behind this change in direction was in 2013 as the Russian parliament relaxed the role of the natural gas company Gazprom in producing and exporting gas globally. This liberalization has fostered competition and the Russian LNG market is a natural area for growth. In March 2017, President Putin stated that "without a doubt Russia not only can but will become the largest producer of liquefied natural gas in the world.” This underlines the political drive for a rapid increase in Russia’s export capacity, especially given its need to bolster national revenue.

The significance of a Russian expansion of LNG exports stems from its geographic location. Given the rising LNG consumption of China, Russia has the potential to supply its needs through pipeline-based supply, in addition to the Japanese market. Such a shift towards the East Asian market by Russia has been precipitated by the progressive application of sanctions by the European Union since March 2014 when Russia was condemned for a violation of Ukrainian sovereignty. The increased tensions, coupled with the inherent challenges faced by the Russian economy, have provided a motivator for increased Russian engagement with its East Asian neighbors.

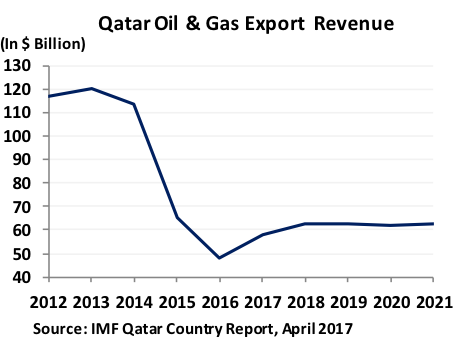

Whilst the new LNG giants are rising, Qatar remains the world leading supplier of LNG. In April 2017, it announced that it would lift the moratorium on the further development of the North Field, the world’s largest non-associated natural gas field. The decision by Qatar to expand its export capacity by 30%, thereby seeing an addition 23mn tonnes per year by 2024; its total LNG production levels are projected to be about 100mn tonnes per year. Unlike the rising LNG giants whom Qatar will need to compete against, it has an advantage in that it has low production costs, which allow it to undercut its rivals on price.

Taken holistically at a geopolitical level, the rise of these major players in LNG, means that existing and future consuming markets for LNG will increasingly be able to draw from the supply in North America, Central Asia, and Australasia. Given the transit route times, a more global supply network can be drawn on by consuming countries. As countries seek to achieve energy security through a diversified energy supply base, these countries have the potential to make clear inroads in markets held by more established suppliers such as Qatar, yet these countries will have to compete on price or offer added-values. In essence, the LNG sector is heating-up to a new era of competition whose primary beneficiary will be consuming countries.

|

| Qatar Oil and Gas Exports Revenue [IMF] |

The Battle for Market Share

Back in 2012 before the Fukushima nuclear reactor meltdown and the Japanese government’s decision to take its effectively suspend its nuclear power sector, the global gas was showing signs of an oversupply of gas. In the aftermath of this decision, Japan turned to gas to meet its electricity needs, which proved a welcome respite for the global LNG industry given it soaked-up excess capacity. Nuclear power had constituted 29% of Japan’s power needs, but its reactors are slowly restarting. It has been estimated that by 2019, Japan will have ten nuclear reactors in operation which will contribute upwards of 7% of its power needs. When coupled with its declining population-base as a result of its aged population structure, a progressively declining consumption pattern of LNG can be expected from what is currently the world’s largest LNG consumer. The restarting of Japan’s nuclear reactors also has an economic impetus the move towards LNG instead of nuclear energy, caused a turning a deepening trade imbalance which widened from ¥6.5tn ($62.5bin) in 2012, to ¥11.5tn ($111bn) in 2013.

Whilst Japan’s appetite for LNG has clearly peaked and will slowly decline, it is increasingly aiming to achieve cooperation between buyers of LNG and through energy trading hub developments. (7) Nevertheless, it is fortunate for the supplying nations that there is rising demand in two key markets: China and India. What is interesting here is that these states will constitute the focus of future efforts in terms of securing a new market share in the context of a rapid rise in production capacity, in addition to the other states of Japan and South Korea where the emphases will be on defending market share.

China’s LNG demand is progressively increasing. It was with Beijing’s new strategy to move away from coal-based power production by 2010, that it has set a tone for the country as a whole which has given a clear boost for the nations gas consumption. China emerged as the world second largest importer of LNG in 2017, marginally ahead of South Korea, with both states consuming around 14% of global demand. Whilst both are dwarfed by Japan consumption of 32% of global LNG, China’s consumption can be expected to rise. Nevertheless, although it is a matter of debate how much larger China’s appetite for LNG may be, it is potentially the largest market where sizable increases in demand can be projected.

In addition to China, it will be India which is going to be a key battleground for the LNG giants. India recently announced that it planned to double the use of natural gas in its energy mix to 15% by 2030, up from 6.2% in 2018. (8) This strategic approach will see India build 11 LNG import terminal over the next seven years. The vast majority of India’s long-term LNG imports are largely sourced from Qatar, but its growth as a target market is limited only by the pace to which its new LNG terminal can become operational.

Whilst new entrants to the LNG market are increasingly asserting themselves, operators in Australia, the United States, and Russia will mainly adopt a ‘tolling agreement’ in the sale of their LNG, as this will force competition within the market. (9) As discussed earlier, there are benefits from having a ‘combined purchase and sale agreement’ and these can be expected to continue, but the destination clauses that have been built into contracts which have ‘combined purchase and sale agreement’ character, look increasingly likely to be unsustainable owing to the establishment of energy trading hubs and collaboration between major buyers.

|

| US Natural Gas Exports and Imports [CSIS] |

Concluding Observations

It was in 2005 that the former US Secretary of State, Henry Kissinger, remarked that, “the great game is developing again…the amount of energy is finite, up to now in relation to demand, and competition for access to energy can become the life and death for many societies. It would be ironic if the direction of pipelines and locations become the modern equivalent of the colonial disputes of the 19th century.” (10) Whilst competition over sparse supplies can bring conflict, the LNG market presents an equally complex chessboard: the supply side is increasingly being dominated by the LNG giants of Qatar, USA, Russia, and Australia. Thus far, there is little to indicate that these states will cooperate in a meaningful way given the dominance they will have oversupply in the LNG market. Cooperation would be a lost opportunity for them. At this stage, competition is more likely and what can be expected is a progressive trend towards a liberalization of the way in which LNG is sold. In the absence of a clear strategy or drive for cooperation, their competition will clearly be to the benefit consuming countries as they will be able to secure favorable trade deals, both in terms of price and flexibility.

It is worth noting that the OPEC cartel controls around 60% of all crude oil traded globally: conversely, in the LNG sector, the rising quadripartite of Japan, South Korea, China, and India, constitute global LNG demand well in excess of that figure. The potential and logic for cooperation on LNG procurement will not be lost on these countries given their own energy security and national economic interests. It was noteworthy that in 2018, Japan, China, and South Korea signed a tripartite agreement cooperate on LNG procurement, yet what can be expected, is that India will seek to join this buyers' club. By doing so, the potential for the buyers to dictate how LNG is traded and priced has the potential to be transformational for the sector.

(1) M. Fagan, (2000) Sheikh Yamani predicts price crash as age of oil ends. The Telegraph, p.25

(2) IEA. (2011). World Energy Outlook 2011 Special Report: Are We Entering a Golden Age of Gas? (Paris: OECD Publishing) pp. 125

(3) IEA. (2016). Medium-Term Gas Market Report 2016 (Paris: OECD Publishing) pp. 126

(4) S. Wright, (2017). Qatar's LNG: Impact of the Changing East?Asian Market. Middle East Policy, 24(1), pp. 154-165.

(5) Anonymous, (2016) "Panama Expansion Puts East Asia in Reach of Nascent US LNG Exports," MEES2016.

(6) H. Gloystein (2017) “China becomes world's No.2 LNG importer in 2017, behind Japan” Reuters

(7) J. Stern, "The New Japanese LNG Strategy: A Major Step Towards Hub-Based Gas Pricing in Asia," Oxford Institute for Energy Studies, OIES Energy Comment, no. June (2016).

(8)R. Clyde, (2017) “India rushing to join natural gas boom risks eventual LNG shortage” Reuters

(9) R. Piet and S. Wright, (2016) "The Dynamics of Energy Geopolitics in the Gulf and Qatar’s Foreign Relations with East Asia," in Energy Relations and Policy Making in Asia, ed. Leo Lester (London: Palgrave Macmillan, 2016) pp. 161-179