President Trump’s declared economic protectionism has taken the United States’ international relations with several foes and allies to some uncharted territories. His open-ended trade wars toward several nations have triggered criticism among conservatives and liberals alike in the United States. He has justified his actions by arguing for a downturn of America’s trade deficit. However, a recent Harvard CAPS/Harris Poll survey shows 63 percent of registered voters said that tariffs imposed on Chinese products ultimately hurt the U.S. more than China; while 74 percent said that American consumers are shouldering most of the burden of those tariffs. (1) The political network funded in part by billionaire libertarian Charles Koch has contested Trump’s approach toward China, and decided to shape an alternative strategy in the year of the U.S. Presidential elections. One Koch senior official has acknowledged, “It doesn’t penetrate with the people that are willing to go along with the argument that you have to punish China.” There is now a pursuit of a “two steps back strategy,” which will involve putting together a team of almost 100 business leaders to call on the Trump administration and lawmakers to end the trade war with China. (2)

In this paper, James M. Dorsey, senior fellow at the S. Rajaratnam School of International Studies at Singapore's Nanyang Technological University and the Middle East Institute of the National University of Singapore, examines the ramifications of President Trump’s policy of economic sanctions and tariffs vis-à-vis several nations and international groupings. He also looks at China’s counter strategy, and whether Middle Eastern countries, like Saudi Arabia, will be caught in the web of the current trade wars.

US President Donald J. Trump may not like armed conflict, but he sure loves economic warfare, whether it is to impose his political will on countries, protect sectors of the U.S. economy, secure more preferential trade terms, or stop others from gaining technological advantage.

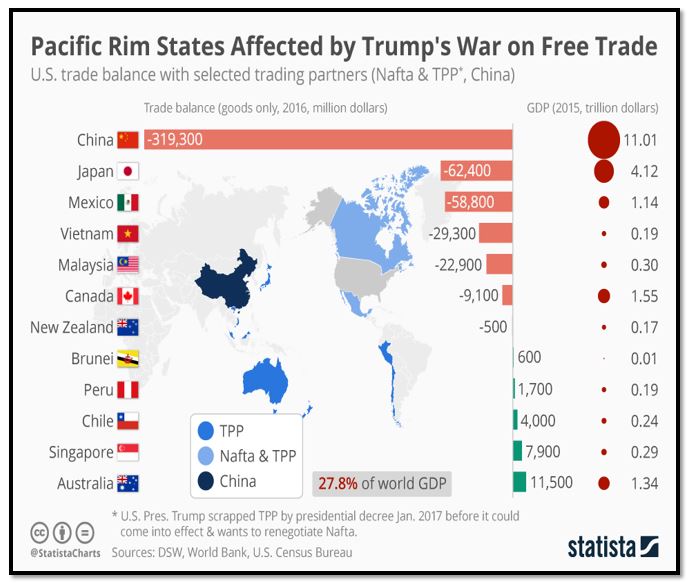

The list of countries subject to sanctions or import tariffs designed to force changes in either economic, military, or geopolitical policies is long and includes both U.S. allies and rivals. Since Trump assumed presidency in January 2017, he has sanctioned China, North Korea, Russia, Venezuela, Iran, the European Union, Myanmar, Syria and Cuba. In one of his first actions after entering the Oval Office, he pulled the United States out of the Trans Pacific Partnership (TPP). (3). He has also sought to undermine the World Trade Organization (WTO), a US-inspired pillar of global trade. (4)

President Trump’s liberal use of sanctions amounts to more than a penchant for economic warfare in an effort to create trade terms more advantageous to the United States. Economic warfare is the president’s strategy to shape a new world order that is likely to be multi-polar. Almost three years into Trump’s administration, it is proving to be a strategy with unintended consequences. Trump is not the only leader to discover that the employment of trade, commerce, and investment as not only an economic; but also political tool can be a double-edged sword.

Conspiring by Default

So is the Chinese president Xi Jinping as he confronts mounting anti-Chinese sentiment in Eurasia and greater competition on China’s border in the Russian Far East. Both leaders are forced to respond to external shocks, like mounting tension between Saudi Arabia and Iran in the wake of recent brazen drone and missile attacks on the kingdom’s oil installations. These attacks have led to a temporary cut of Saudi oil production by half, and are likely to change trading patterns, particularly in energy, not only of China; but also, of multiple other Asian states, including Japan, South Korea and India.

Trump’s protectionist penchant for economic warfare, 15 months before next year’s US presidential election, that breaks with 85 years of U.S. trade and economic policy that emphasized free trade and open markets, has yet to produce a foreign policy success. China and Russia, determined to counter U.S. power, particularly in Asia, have forged ever-closer ties. Iran and North Korea have demonstrated the resilience to endure harsh sanctions. Nicholas Maduro retains his grip on Venezuela while Europe is increasingly exasperated with America and discussing ways of improving relations with Russia to counter China. (5)

Trump’s renegotiation of the North American Free Trade Agreement (NAFTA), renamed the United States-Mexico-Canada Agreement (USMC), weakened protections for investors in Mexico as well as government commitment to allow foreign companies to bid for procurement contracts. While building a review process to the Agreement, this policy has created a sense of instability. President Trump enhanced uncertainty by subsequently threatening to impose new tariffs on Mexico because he did not like the country’s handling of Central Asian asylum seekers. (6)

Former World Bank president, U.S. trade representative and deputy-secretary of state Robert B. Zoellick predicts that Trump is likely to continuously wage economic warfare and keep trade partners off balance. “He will not change. Trade…is a core issue for the president’s political base. He must keep it boiling,” Mr. Zoellick said in a Wall Street Journal Pp-Ed entitled “The Trade War’s Winners Don’t Include Us”. (7)

As a result, damage to U.S. credibility and ability to regulate the international political and economic order may outlast Trump’s sanctions and tariffs-driven policies. Countries like China and Russia are likely to expand trade relations with third countries, and shift supply chains at the expense of preferential U.S. access to markets. They may also defy U.S. secondary sanctions, which target third country companies and entities, which refuse to comply with, for example, sanctions against Iran, and initiate ways of undermining the global reserve function of the U.S. dollar.

|

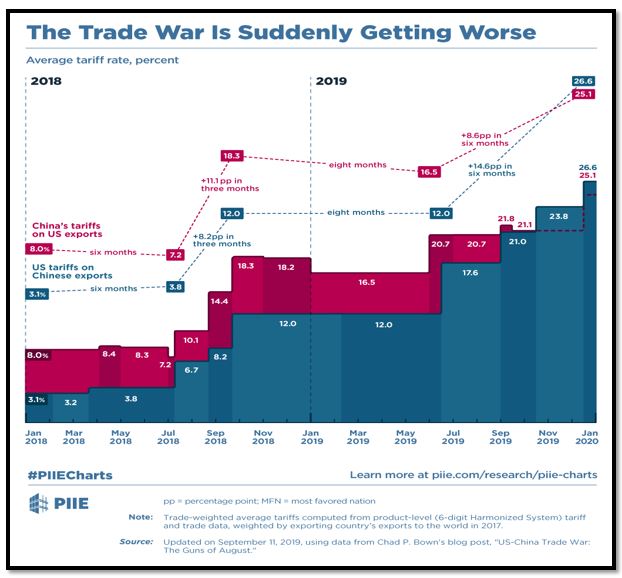

| The Trade War Timeline [PIIE] |

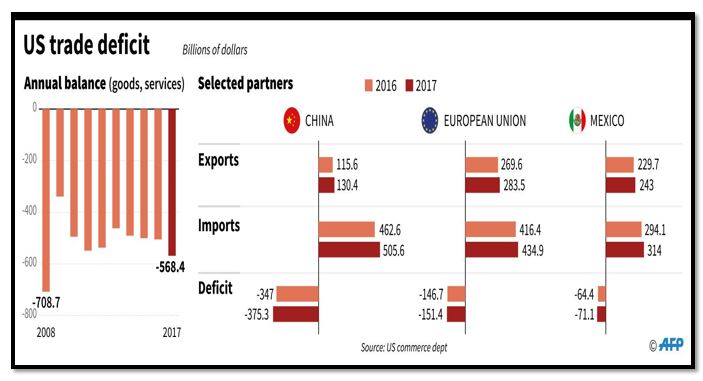

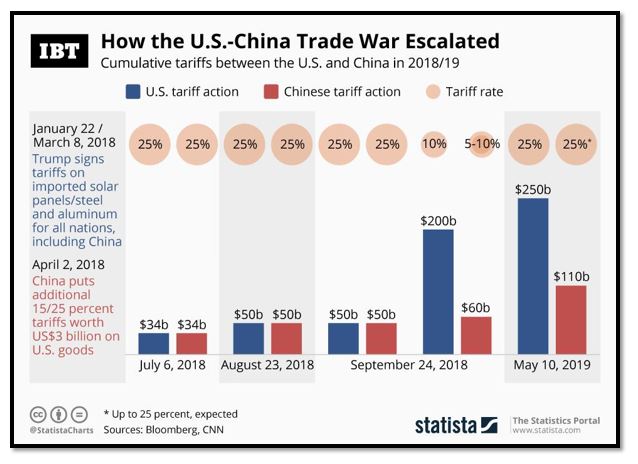

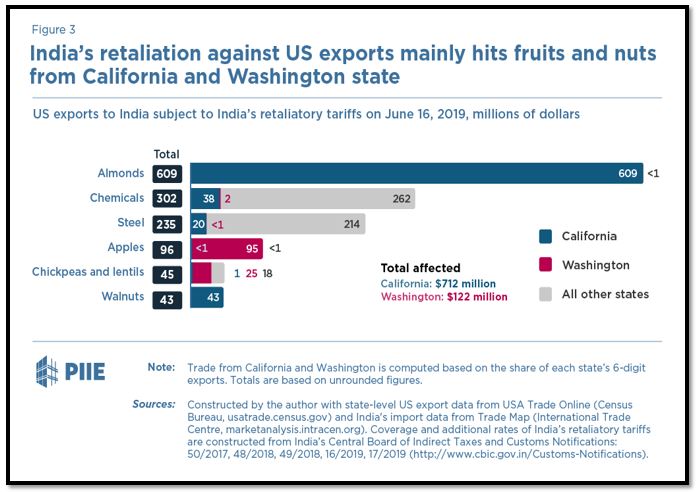

U.S. losses are palatable. The TPP has lowered trade barriers for member countries (8) but not for the United States. The EU has gained preferential access to Japan (9) while China has retaliated with tariffs of 21.8 percent on U.S. products (10) and lowered them to 6.7 percent for others. (11) The U.S. Treasury has doled out billions of dollars agricultural exporters (12) who have lost significant market share in China that they will find difficult to recover. U.S. manufacturers are moving operations to third countries (13) to evade the impact of the U.S.-China trade war while foreign direct investment in the United States is dropping. (14) Chinese investment in the United States has plummeted in the last two years. (15) Meanwhile, India and the United States are erecting barriers of their own (16) that will negatively affect bilateral trade while negotiations with the EU are stalled. (17)

President Trump’s trade wars have reduced the United States’ ability to establish rules and standards that govern key sectors like medical services, finance, intellectual-property rights, data access and security; enable the fight against corruption and promote transparency; “This president disdains rules; he acts as if governments control purchases like in old-style mercantilism,” Mr. Zoellick said. “Trump thinks that trade policy at 3 o’clock in the morning,” added Democratic presidential candidate Bernie Saunders. (18)

Bullying Does the Job

Mr. Trump’s erratic approach towards policy-making and implementation implies bullying will do the job and vacillation between bluster and moderation has projected him as an unreliable and impossible negotiator. This approach showcases a sharp contrast to his self-styled portrayal of himself as the master of the ‘Art of the Deal’. At the risk of sparking the emergence of parallel economic worlds, one dominated by the United States, the other by China, President Trump assumes his trade war and efforts to block Chinese access to U.S. technology would sabotage President Xi Jinping’s ‘Made in China 2025’ program designed to make China commercially and industrially self-sufficient. Trump further sees his trade war as a way of halting China’s efforts to replace the U.S. as the world’s foremost, cutting-edge economy. Reporting on a recent visit by Mr. Xi to Henan Province, Communist Party newspaper reported the president had “urged the development of the real economy bolstered by manufacturing, with self-reliance as the basis of all endeavours.” (19)

Mr. Trump may be right in his identification of the threat that China poses to U.S. economic and geopolitical dominance. The problem is that his policy solution risks accelerating the process rather than pausing or reversing it. Rather than stimulating research and development needed to ensure an American lead, Trump seems to believe that undermining China’s abilities is the key. The threat of the demise of a global market and the rise of parallel markets appears to have reinforced Chinese determination to become self-reliant to the degree possible.

“A more competitive United States would be a stabilizing force,” said Ely Ratnert the executive vice president of the Center for a New American Security and former deputy national security adviser to Vice President Joe Biden, arguing that U.S. strategy should involve both engagement and containment. (20)

|

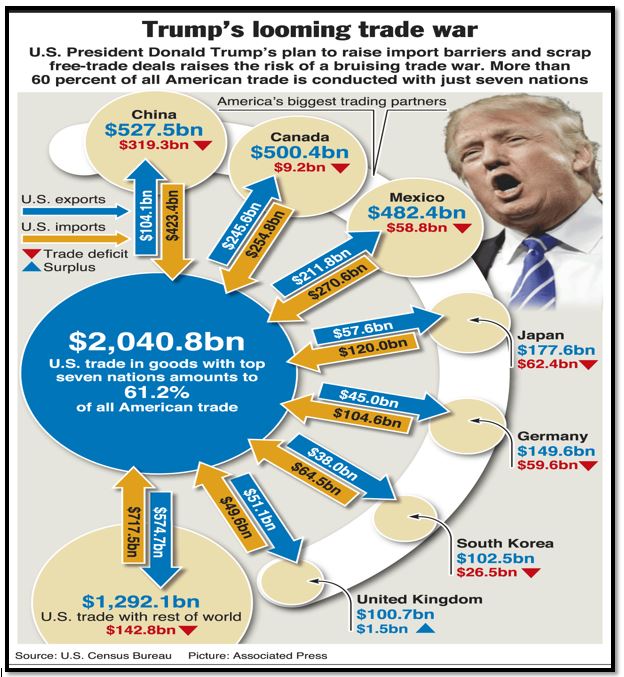

| Trump's Looming Trade Ward [AP] |

Differences between China’s response to U.S. sanctions on telecommunications equipment and systems maker ZTE Corporation that threatened to bring the company down and Huawei, another major Chinese telecom equipment manufacturer, suggest that President Xi has factored the emergence of parallel worlds into his thinking. Last year, he phoned President Trump to plead with him to lift a crippling seven-year ban on the acquisition of U.S. components by ZTE. (21) The ban, imposed in response to allegation of ZTE’s busting of sanctions against Iran and North Korea, effectively sounded the death knell for ZTE, which has a workforce of 75,000. Trump agreed to lift the ban in exchange for ZTE agreeing to pay a U.S. $1.3 billion fine, undertake sweeping management changes, and hire American compliance executives to monitor internally the company.

No such deal was available to Huawei, neither would President Xi be willing to accept another deal that he would have perceived as reminiscent of China’s historical humiliations at the hands of Western powers. Huawei has responded defiantly to U.S. sanctions, (22) the detention in Canada at the behest of the United States of its Chief Financial Officer, Meng Wanzhou, (23) daughter of the company’s founder, Ren Zhengfei, on charges of financial fraud, sanctions violations, obstruction of justice; and a global campaign to prevent companies from acquiring Huawei’s 5G technology. The reason was the company’s close ties to the military and security forces. (24) In line with what has been termed the decoupling of the U.S. and Chinese economies, Huawei introduced Harmony, its own operating system to rival Android; and make it less dependent on U.S. technology. (25)

In September 2019, the Trump administration took a further step towards decoupling with the proposed new rules, which would allow the United States to exert greater control over foreign investment, by broadening the government’s authority to block technology and real estate transactions. The rules would give the Committee on Foreign Investment in the United States, or CFIUS, greater power to stop foreign investment in areas the U.S. deems protected, a move that primarily aims to bar China from access to sensitive American technology and other valuable assets. Beyond technology, the rules would red flag investment in infrastructure, such as telecommunications, utilities and energy as well companies that collect sensitive personal data related to finance and health, particularly of individuals and/or federal employees involved in national security. Real estate acquisitions would be vetted on proximity to military installations, airports and ports. (26)

|

| US Trade Deficit [European Data News] |

Chinese Trade Policy Backfires

If President Trump has demonstrated his inclination to wage economic wars, his Chinese counterpart, President Xi, sees trade and foreign investment as a way of not only securing economic growth by imposing increasingly controversial commercial terms; but also, achieving China’s geopolitical goals and promoting its concept of an invasive surveillance state. With countries like Pakistan, Malaysia, Myanmar and Nepal questioning projects that fail to respond to local needs and fail to contribute to economic growth because they rely on Chinese labor and materials, China has conceded that it may have to make adjustments to a policy that by default rather than design could end up contributing to decoupling.

"It is normal and understandable that development focus can change at different stages in different countries, especially with changes in government. So China can also make some strategic adjustments when cooperating with these countries, but it is definitely not a reconsideration of the B&R (Belt and Road) initiative," Wang Jun, deputy director of the Department of Information at the China Center for International Economic Exchanges told the Global Times newspaper. (27)

Mr. Jun spoke as Chinese foreign minister, Wang Yi, was confronted on a visit to Islamabad with Pakistani demand that China should refocus its U.S. $45 billion plus investment in the China Pakistan Economic Corridor (CPEC), the single largest country infrastructure investment related to the People’s Republic’s Belt and Road initiative, to emphasize manufacturing and poverty reduction projects. (28) The Pakistani demand amounted to a rejection of China’s approach that appeared to position Pakistan as a raw materials supplier for China, an export market for Chinese products and labour, and an experimental ground for the export of the surveillance state China is rolling out, particularly in its troubled north-western province of Xinjiang. (29)

|

| How the US-China Trade War Escalated [STATISTA] |

Elsewhere in Asia, some countries were putting their money where their mouth was. Chinese commercial terms prompted Nepal, like Pakistan to withdraw from a Chinese-funded dam project. (30) Furthermore, protests against the forced resettlement of eight Nepali villages persuaded CWE Investment Corporation, a subsidiary of China Three Gorges, to cancel a 750MW hydropower project. (31)

In July, Malaysia restarted the China-linked East Coast Rail Link project after forcing China to agree to downsizing construction costs by a third. The rail project, led by China Communications Construction Co. and Malaysia Rail Link Sdn., was cancelled in 2018 by Prime Minister Mahathir Mohamad after he balked at the U.S. $16 billion cost. (32) The rail scheme was one of several projects, including a natural gas pipeline, suspended or cancelled by Mr. Mahathir after taking office in May 2018. (33) Similarly, Myanmar forced China to scale back its Kyaukphyu deep-sea port project from U.S. $7.5 billion to 1.3 billion. (34)

Even China’s approach towards trade with Russia, its closest ally, has sparked anti-Chinese sentiment and raised questions of whether the current state of affairs is sustainable. Chinese investment in Russia is a fraction of China’s investment in other regions like sub-Saharan Africa or South America and less than China’s expanding stake in countries like Nigeria and Brazil. A Chinese-Russian agreement on economic cooperation in Siberia, Russia’s Far East and China’s Northeast for a period of nine years ending in 2018 has fallen far short of expectations.

The agreement identified 91 joint investment projects of which only 11 materialized. (35) Similarly, energy failed to live up to its billing. CEFC China Energy’s plan to acquire a 14 percent stake in Russia’s largest, and majority state-owned, oil company, Rosneft, never happened. Neither did an agreed U.S. $25 billion investment in Russia’s Power of Siberia gas pipeline. The pipeline’s export of 38 billion cubic metres of natural gas is but one source for China that in 2017 imported more than 90 billion cubic meters from Australia, Qatar, and Turkmenistan.

|

| Pacific Rim States Affected by Trump's war on Free Trade [STATISTA] |

Russia scholar Leo Aaron charged that the lopsided nature of Chinese-Russian economic relations fits the definition of Karl Marx and Vladimir Lenin of colonial trade, in which one country becomes a raw material appendage of another. “China is Russia’s second-largest trading partner (after the EU) and Russia’s largest individual partner in both exports and imports, for China the Russian market is at best second-rate. Russia ranks tenth in Chinese exports and does not make it into the top ten in either imports or total trade,” Mr. Aaron said. He noted that three-quarters of Russia’s exports to China were raw materials as opposed to consumer good, electronics and machinery accounted for the bulk of Chinese sales to Russia. (36)

More ominously, China starting in Central Asia, a crucial region that borders on its strategic but troubled north-western province of Xinjiang, is making deployment of its intrusive surveillance systems a pre-condition for investment; and in some cases appears willing to supply the infrastructure at no cost as part of a Smart City project developed by Huawei for initial roll-out in former Soviet states. (37) Huawei says the system, which involves installing thousands of security cameras equipped with artificial intelligence and facial recognition technology in public places, has been exported to 160 cities worldwide.

Liu Jiaxing, head of Huawei’s representative office in Uzbekistan, disclosed China’s insistence on adopting its surveillance approach in an interview with an Uzbek news outlet. “Investors will only go where the situation is stable. In view of this, the implementation of the Safe City project is very important for Uzbekistan as it will help the country develop its investment potential,” Liu said. (38) With no transparent regulation and oversight that ensure Central Asians’ privacy rights, China is likely to have access to data collected by the Smart City technology. Kyrgyzstan’s interior minister said data, one collected, would be handled at no cost to the government by Chinese National Electronics Import and Export Corporation, or CEIEC; a company believed to be tied to the Chinese military whose technology is deployed in Xinjiang, China’s surveillance system laboratory. (39)

|

| India's Retaliation against US Exports [PIIE] |

A Joker in the Game

The Middle East may not be at the core of the trade wars and policies that appear to be reshaping world trade. However, harsh U.S. sanctions on Iran and opposition to them by China, Russia and Europe have enabled Saudi Arabia and Iran to put their stamp on them. Devastating attacks in September on two Saudi oil facilities, which were claimed by Iranian-backed Houthi rebels in Yemen and blamed on Iran by the United States and Saudi Arabia, have prompted the kingdom’s major Asian customers to look at diversifying their supplies, which could force them to upgrade their ability to refine heavier grades of crude. “The key is to gradually get rid of heavy reliance on Middle Eastern oil. There is a consistent risk to oil supply from Middle East countries. China has been diversifying its oil suppliers,” said Zhu Guangming, an analyst from the consultancy Sublime China Information. (40)

China’s diversification options are Russia, the United States and Iran. Russia may be China’s safest bet as long as the U.S. imposes sanctions on Iran while the U.S. is tricky given the trade war. Trading patterns in the immediate aftermath of the attacks in Saudi Araba of Unipec, the trading arm of Chinese oil giant Sinopec, highlight China’s dilemma. Unipec was rushing in early September to sell U.S. oil it had acquired as China imposed a five-percent tariff on imports of American oil. Two weeks later, it was chartering ships to import U.S. light crude to compensate for Saudi shortfalls. (41)

A careful reading of Saudi and U.S. responses to the Saudi attacks suggests subtle differences between the two governments. They mask several emerging fundamental issues that could have far-reaching consequences for the Gulf’s security architecture and energy export focus. U.S. Secretary of State Mike Pompeo and President Trump explicitly pointed the finger at Iran as being directly responsible, (42) while Saudi Arabia stopped short of blaming the Islamic republic, saying that its preliminary findings showed that Iranian weapons had been used in the attack. (43) Iran has denied any involvement. (44)

Saudi Arabia’s initial reluctance to unambiguously blame Iran may have a lot to do with Trump’s America First-driven response to the attacks, which appeared to contradict the Carter Doctrine proclaimed in 1980 by President Jimmy Carter. The doctrine, a cornerstone of the Saudi-U.S. relationship, stated that the United States would use military force, if necessary, to defend its national interests in the Gulf.

Trump’s apparent weakening of the United States’ commitment to the defense of the Kingdom, encapsulates in the doctrine, risks fundamentally altering the relationship, already troubled by Saudi conduct of the more than four-year-long war in Yemen and last year’s killing of journalist Jamal Khashoggi in the Saudi consulate in Istanbul.

Signalling a break with the Carter doctrine, Trump was quick to point out that the attacks were on Saudi Arabia, not on the United States; and suggested it was for the Saudis to respond. “I haven’t promised Saudis that. We have to sit down with the Saudis and work something out. That was an attack on Saudi Arabia, and that was not an attack on us. But we would certainly help them,” Mr. Trump said without identifying what kind of support the U.S. would be willing to provide. (45)

Despite blustering that the United States was “locked and loaded,” Trump insisted “we have a lot of options but I’m not looking at options right now.” Mr. Trump further called into question the nature of the U.S.-Saudi defense relationship by declaring that “If we decide to do something, they’ll be very much involved, and that includes payment. And they understand that fully.”

Conclusion

The structure of global trade is by design or default in flux with potentially far-reaching conclusions for international relations as well as political systems in various countries. The escalating trade war between the United States and China risks a breakdown in global trade as the world’s two largest economies contemplate encouraging the emergence of trading environments that they would dominate. Add to that, the impact of Mr. Trump’s penchant for economic sanctions, that in the case of Iran, have sparked escalating tension between Saudi Arabia and the United States that could reshape security perspectives in the Gulf and could lead to alternative flows of energy to Asia’s largest importers. The possible decoupling of the Chinese and U.S. economies would make it easier for China to politically align some beneficiaries of China’s Belt and Road initiative by imposing its concept of a 21st-century Orwellian surveillance state on them.

- Max Greenwood, “Poll: Voters want US to confront China over trade’, The Hill, September 3, 2019 https://thehill.com/policy/finance/459746-poll-voters-want-us-to-confront-china-over-trade

- Brian Schwartz, “‘We were wrong’: Koch network to change strategy against Trump’s trade war after ad campaign falls short”, CNBC, September 19, 2019 https://www.cnbc.com/2019/09/19/we-were-wrong-koch-network-plans-new-strategy-against-trump-tariffs.html

- Office of the United States Trade Representative, The United States Officially Withdraws from the Trans-Pacific Partnership, January 2017, https://ustr.gov/about-us/policy-offices/press-office/press-releases/2017/january/US-Withdraws-From-TPP

- The Washington Post, Trump on WTO: ‘We will leave if we have to,’ YouTube, 13 August 2019, https://www.youtube.com/watch?v=BnqV3nso9KY

- Michael Peel, EU envoy urges bloc to engage more with Russia over 5G and data, Financial Times, 13 August 2019, https://www.ft.com/content/725aa5b6-d5f7-11e9-8367-807ebd53ab77

- Meg Wagner and Brian Ries, Trump threatens tariffs on Mexico over immigration, CNN, 31 May 2019, https://edition.cnn.com/politics/live-news/trump-mexico-tariffs-immigration-2019/index.html

- Robert B. Zoellick,The Trade War’s Winners Don’t Include Us, The Wall Street Journal, 4 September 2019, https://www.wsj.com/articles/the-trade-wars-winners-dont-include-us-11567636887

- 3E Accounting, Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) Signed To Lower Trade Barriers Across The Region, Undated, https://www.3ecpa.com.sg/regulatory-and-business/cptpp-signed-to-lower-trade-barriers-across-the-region/

- European Commission, The EU-Japan agreement explained, 6 February 2018, https://ec.europa.eu/trade/policy/in-focus/eu-japan-economic-partnership-agreement/agreement-explained/

- Annalisa Merelli, The full list of 128 US products targeted by China’s retaliatory tariffs, Quartz, 2 April 2018, https://qz.com/1242652/china-tariffs-the-complete-list-of-128-affected-good-class-of-goods/

- J. R. Reed, China is lowering tariffs on other countries amid trade war with the US, CNBC, 27 August 2019, https://www.cnbc.com/2019/06/19/china-lowers-trade-barriers-for-other-countries-amid-us-tensions.html

- Mary Papenfuss, Trump Seeks New $15 Billion Subsidy To Protect Farmers From His Own Trade War, HuffPost, 13 May 2019, https://www.huffpost.com/entry/trump-trade-war-15-billion-farm-subsidy_n_5cd89043e4b054da4e8b5593

- Tori K. Whiting, Trump’s Tariffs Are Pushing American Companies to Leave, The Heritage Foundation, 2 July 2018, https://www.heritage.org/trade/commentary/trumps-tariffs-are-pushing-american-companies-leave

- Rachel Layne, Foreign investment in U.S. dropping dramatically under Trump, CBS News, 1 August 2018, https://www.cbsnews.com/news/foreign-investment-in-u-s-dropping-dramatically-under-trump/

- Alan Rappeport, Chinese Money in the U.S. Dries Up as Trade War Drags On, The New York Times, 21 July 2019, https://www.nytimes.com/2019/07/21/us/politics/china-investment-trade-war.html?module=inline

- Press Trust of India, US wants India to eliminate trade barriers for American companies: Ross, The Times of India, 7 May 2019, http://timesofindia.indiatimes.com/articleshow/69216604.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

- Daniel Boffey, Hopes of EU-US trade agreement put on ice, say Brussels sources, The Guardian, 5 June 2017, https://www.theguardian.com/business/2017/jun/05/hopes-of-eu-us-trade-agreement-put-on-ice-say-brussels-sources

- Iran Daily, Democrats in presidential debate blast Trump’s trade policies, MSN, 13 September 2019, https://www.msn.com/en-xl/news/other/democrats-in-presidential-debate-blast-trump-e2-80-99s-trade-policies/ar-AAHgjvr

- Chu Daye and Yang Kunyi, President Xi stresses industrial self-reliance, Global Times, 18 September 2019, http://www.globaltimes.cn/content/1164852.shtml

- Ellen Nakashima, Generational clash emerges among U.S. experts in China policy debate”, The Washington Post, August 17, 2019 https://www.washingtonpost.com/national-security/generational-clash-emerges-among-us-experts-in-china-policy-debate/2019/08/17/25f024c4-c03c-11e9-a5c6-1e74f7ec4a93_story.html

- Wang Xiangwei, Xi Jinping’s ZTE concession to Donald Trump still haunts Chinese negotiators in US trade talks, South China Morning Post, 27 July 2019, https://www.scmp.com/week-asia/opinion/article/3020305/xi-jinpings-zte-concession-donald-trump-still-haunts-chinese

- Charles Arthur, Huawei, sanctions and software: everything you need to know, The Guardian, 8 December 2018, https://www.theguardian.com/technology/2018/dec/08/huawei-sanctions-software-what-you-need-to-know

- Lev Sugarman, Document: Indictment of Huawei, Huawei Subsidiaries and CFO Meng Wanzhou, Lawfare, 28 January 2019, https://www.lawfareblog.com/document-indictment-huawei-huawei-subsidiaries-and-cfo-meng-wanzhou

- Arjun Kharpal, Huawei staff share deep links with Chinese military, new study claims, CNBC, 8 July 2019, https://www.cnbc.com/2019/07/08/huawei-staff-and-chinese-military-have-deep-links-study-claims.html

- CNN, Huawei launches operating system as a hedge in trade war, 9 August 2019, https://edition.cnn.com/videos/tech/2019/08/09/huawei-launches-new-harmony-operating-system-rivers-sot-first-move.cnn

- Alan Rappeport, U.S. Outlines Plans to Scrutinize Chinese and Other Foreign Investment, The New York Times, 17 September 2019, https://www.nytimes.com/2019/09/17/us/politics/china-foreign-investment-cfius.html

- Shen Weiduo, China open to adjustment of B&R projects based on countries' needs: analysts, Global Times, 13 September 2018, http://www.globaltimes.cn/content/1119564.shtml

- Saeed Shah, Pakistan Pushes China to Realign Goals in Its Belt-and-Road Initiative, The Wall Street Journal, 12 September 2018, https://www.wsj.com/articles/pakistan-pushes-china-to-realign-goals-in-its-belt-and-road-initiative-1536773665

- James M. Dorsey, One Belt, One Road: A plan for Chinese dominance and authoritarianism, The Turbulent World of Middle East Soccer, 18 May 2017, https://mideastsoccer.blogspot.com/2017/05/one-belt-one-road-plan-for-chinese.html

- Kamran Bokhari, China’s One Belt, One Road Faces Pushback, Geopolitical Futures, 21 November 2017, https://geopoliticalfutures.com/chinas-one-belt-one-road-faces-pushback/

- Indrani Bagchi, Nepal cancels Budi Gandaki hydropower project with Chinese company, The Times of India, 15 November 2017, https://timesofindia.indiatimes.com/world/south-asia/nepal-cancels-budi-gandaki-hydropower-project-with-chinese-company/articleshow/61648419.cms

- Anisah Shukry, Malaysia Restarts Rail Project With China After Cost Cut, Bloomberg News, 25 July 2019, https://www.bloomberg.com/news/articles/2019-07-25/malaysia-restarts-rail-link-project-with-china-after-cost-cut

- Liz Lee, Rozanna Latiff, Ben Blanchard and Praveen Menon, Malaysia's Mahathir cancels China-backed rail, pipeline projects, Reuters, 21 August 2018, https://www.reuters.com/article/us-china-malaysia-idUSKCN1L60DQ

- Thompson Chau, China-led port project inches ahead in Myanmar, Asia Times, 15 July 2019, https://www.asiatimes.com/2019/07/article/china-led-port-project-inches-ahead-in-myanmar/

- Ivan Zuyenko, A Chinese-Russian Regional Program Ends With a Whimper, Carnegie Moscow Center, 26 September 2018, https://carnegie.ru/commentary/77341

- Leon Aaron, Are Russia and China Really Forming an Alliance? Foreign Affairs, 4 April 2019, https://www.foreignaffairs.com/articles/china/2019-04-04/are-russia-and-china-really-forming-alliance?utm_medium=social&utm_source=twitter_cta&utm_campaign=cta_share_buttons

- Huawei, Smart City, https://e.huawei.com/en/solutions/industries/smart-city

- Podrobno.uz , Цифровой рубеж. Каким будет будущее проекта "Безопасный город" в Узбекистане (Digital Frontier. What will be the future of the Safe City project in Uzbekistan), 27 August 2019 : https://www.podrobno.uz/cat/uzbekistan-i-kitay-klyuchi-ot-budushchego/tsifrovoy-rubezh-kakim-budet-budushchee-proekta/

- 24kg, Interior Ministry of Kyrgyzstan cooperates with Chinese company CEIEC, 29 August 2019, https://24.kg/english/127757_Interior_Ministry_of_Kyrgyzstan_cooperates_with_Chinese_company_CEIEC/

- Financial Times, Asia looks to diversify after attacks on Saudi oil production, 18 September 2019, https://www.ft.com/content/6d22dbf4-d921-11e9-8f9b-77216ebe1f17

- Ellen R. Wald, Attack On Saudi Oil Is Boon For Trump In China Trade War, Forbes, 18 September 2019, https://www.forbes.com/sites/ellenrwald/2019/09/17/attack-on-saudi-oil-is-boon-for-trump-in-china-trade-war/

- Steve Holland and Roberta Rampton, Wary of conflict with Iran, Trump takes go-slow approach to attack on Saudi oil, Reuters, 18 September 2019, https://news.yahoo.com/wary-conflict-iran-trump-takes-233213964.html

- Vivian Nereim, Abbas Al Lawati, and Bill Faries, Saudi Arabia Says Iranian Weapons Used to Attack Oil Facilities, Bloomberg, 16 September 2019, https://www.bloomberg.com/news/articles/2019-09-16/saudi-led-yemen-coalition-says-iran-weapons-used-in-oil-attacks

- Kareem Fahim, Anne Gearan, Erin Cunningham and Steven Mufson, Iran denies role in attacks on Saudi oil facilities; Trump says U.S. is ‘locked and loaded,’ The Washington Post, 16 September 2019, https://www.washingtonpost.com/world/iran-dismisses-allegations-it-carried-out-crippling-attack-on-saudi-oil-facilities/2019/09/15/021b6822-d731-11e9-8924-1db7dac797fb_story.html

- Steve Holland and Rania El Gamal, Trump says he does not want war after attack on Saudi oil facilities, Reuters, 16 September 2019, https://www.reuters.com/article/us-saudi-aramco-idUSKBN1W10X8